Nothing is more important to CME Group than the integrity of our markets – participants from around the world turn to our agricultural markets for the efficiency, transparency, resiliency, and liquidity they need to manage risk. This paper highlights some of the critical components that make our markets the best in the world, including our order matching process, the market integrity and risk controls we pioneered, and the resources deployed to monitor the markets for aberrant or disruptive activity.

Placing A Trade in The Market

Futures and options trading has transitioned from a mostly trading-pit-based system to a predominantly electronic market. Today, traders can enter electronic orders manually or through automated systems such as auto-spreaders and defined algorithms. While there are a variety of different approaches to entering orders, it is important to remember that customers are prohibited by exchange rules from putting bids or offers in the order book that they do not intend or are financially unable to execute.

Regardless of how a trade is entered, there are controls on the actions that every trader can take. Credit controls and maximum order quantities are hard wired into the system to make the market function as efficiently as possible at all times.

The Central Limit Order Book

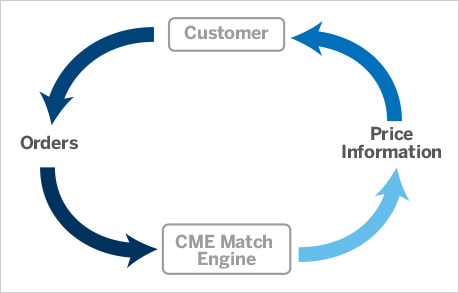

As orders are entered, modified, and cancelled, CME Globex collates this activity into a central limit order book (CLOB) that represents buying and selling interest at each price level for each futures and options instrument available for trading. This price information is then disseminated to the marketplace through market data, which is available both as the quantity available at each price (i.e. “market by price”) or the quantity available on each order at each price (“market by order”). For example, market by price data is disseminated for the top 10 price levels for grains and oilseeds futures, the top five price levels for livestock and dairy futures and the top three price levels for ag options. Market by order data is available at every price level.

Executing Orders in the CLOB

Customers can enter orders into CME Globex using a range of trading applications, including front-end applications provided by a vendor, broker or clearing firm, or developed by the trading firm itself. How these applications connect to CME Globex may impact the speed at which a participant can interact with the market. For instance, an application hosted on a computer server closer to the CME Group trade matching infrastructure will be faster to the market than an application hosted on a server farther away. The trading strategy of the participant typically dictates the type of application they use and the mechanisms by which they access the market.

In executing orders, it is important to understand that, while the book is locked during the execution of a given order, it unlocks between match events. This means when an order is being executed, no one can cancel or modify any order that is in the book. Once it unlocks, new orders, including cancels and modification can be entered, and the next order in sequence is executed.

This has implications for how customers place large orders. Let’s consider a customer who wants to execute a 500-contract buy order, and there are 500 contracts available at the best offer price. If he places a single order to buy 500 contracts at the best offer price, the book will lock and his buy order will begin matching opposite the resting sell quantity. While the 500-lot buy order is being matched, no other updates to the order book can occur.

Alternatively, if the customer places two separate orders to buy 250 contracts each, it is possible that orders from other participants are received by CME Globex in between the customer’s two separate orders. In this scenario, those other orders could alter the order book, including the quantity available at different price levels. For instance, suppose that in between the customer’s first and second 250-lot buy orders, another participant had placed an order to cancel 150 contracts he had resting at the best offer.

- The customer’s first 250-lot buy would be filled in full as there were 500 contracts available at the best offer price. The resting quantity at the best offer would accordingly be reduced to 250 contracts.

- The other participant’s 150-lot cancellation then further reduces the quantity at the best offer to 100 contracts.

- When the customer’s second 250-lot buy order arrives at CME Globex, it would trade in part opposite the resting 100 contracts at the best offer. The remainder of the customer’s order would rest in the order book at a new best bid price.

Importantly, participants are expected to be aware of the market conditions at the time of entering an order, including the size of the order relative to the displayed quantities in the order book. It is a violation of exchange rules to engage in disruptive order entry and trading practices that may be abusive to the orderly conduct of trading or the fair execution of transactions. For more information, see the FAQ on Rule 575.

Executing Alternative Order Types

For the vast majority of agricultural customers, our deep, liquid futures and options on CME Globex are the primary means of price discovery and risk transfer. In some instances, customers may choose to use alternative order types, like block trades or crosses, to ensure they get the best possible execution in a cleared and highly regulated environment. Blocks trades are executed outside of the CLOB and submitted through CME ClearPort for clearing. They can only be transacted between Eligible Contract Participants and the order size must be greater than a specific block threshold. Crosses can be executed on CME Globex by anyone with a futures account and require no minimum size. These order types can be beneficial in the case of larger orders where it’s important to execute all trades at one price, for hedges further back on the curve, in less-liquid products or spreads or for some options orders.

Using these trade types, a broker can talk to other market participants before the trade to find a counterparty to provide market users with better execution. This type of pre-execution communication is available across all other asset classes at CME Group and became available in agricultural markets in 2018. While these alternative transaction types can help with execution in these unique situations, they represent less than one percent of total agricultural trading volume.

The Role of Speed and Latency

Given that futures and options markets are now almost entirely electronic, speed and latency have become important issues for market participants of all kinds. For market makers, who are constantly adjusting bids and offers as the market moves, low latency can be a top priority so that stale bids and offers are removed from the order book as the market moves to different price levels. For others, who have longer term trading or risk management profiles, speed might be less of a priority than getting a set price.

Customers have a range of options on the speed at which they place orders and how quickly they receive market data from the exchange. These alternatives impact both order entry and market data dissemination. Decisions such as what type of network connections, routing hardware, front-end order-entry and quote systems are being used all impact latency.

- Within CME systems, no customer has a latency advantage versus any other customer. However, the physical location of the trader or the servers hosting his trading application may impact how quickly an order can reach the gateway to CME’s systems.

- CME Group distributes all market data to the public at the same time, and it is equally accessible by all customers.

It is important to appreciate that CME Globex handles each order, modification, or cancellation in the order in which it is received. Once inside the CME system, orders do not have an ability to jump ahead of other orders already in the queue or pipeline. This is critical in comprehending how trades match – once a trade matching process begins, the order book cannot be modified or changed until the trade match is complete and the next order in the queue is processed.

Co-Location

As part of its efforts to deliver access to low-cost connectivity services and support, CME Group allows every customer to rent equidistant connectivity to CME Globex through the exchange, major FCMs or third-party vendors. Costs are commensurate with the capacity needed (number of servers) and range from high-capacity multiple-rack installations to affordable virtual servers for cost-conscious customers.

The reasons for providing this service date back to when electronic markets started gaining significance, as CME Group observed customers buying and renting space as close to its match engine as possible to minimize latency. This gave an advantage to those who were first to obtain the closest real estate. In response, CME Group established a co-location facility so that each customer has a level playing field of access.

Matching Trades for Execution

In pit trading, the broker determined who would get filled opposite a customer order. In an electronic market, an allocation algorithm is used to determine who gets filled and in what amounts. CME Group constantly reviews how its algorithms are performing and uses two different allocation algorithms in our agricultural futures products.

Matching Algorithms

FIFO (First In, First Out)

The FIFO algorithm uses price and time as the only criteria for filling an order. In this algorithm, all orders at the same price level are filled according to time priority; the first order at a price level is the first order matched. This gives an advantage to limit orders that have been in the order book at that price level the longest time. FIFO is currently used for livestock outright futures and Black Sea Wheat and Corn futures.

Split FIFO and Pro-Rata (K algorithm)

The Split FIFO/Pro-Rata algorithm is a hybrid which integrates a percent-based allocation on both a FIFO and Pro-Rata formula to the resting order book. This algorithm has been developed with the flexibility to calibrate the level of tradable quantity that is allocated on a FIFO and Pro-Rata basis (A set percentage FIFO, and a set percentage Pro-Rata). This algorithm ensures broader participation in the market. Currently set at 40% FIFO, this algorithm is used for grain and oilseed futures and spreads and livestock spreads. Agricultural options products use the O algorithm, which is threshold Pro-Rata with a top allocation.

For more details on how the various allocation algorithms are applied across our agricultural futures and options markets, visit our CME Group Client Systems Wiki at www.cmegroup.com/confluence. For additional information on which algorithm is applied for a given futures or options product at CME Group, see our CME Globex Product Reference Sheet available via www.cmegroup.com/globex.

Market Protection

Before A Trade Occurs

CME Group has a system of risk controls that must be satisfied before a trader can enter an order. These protections guard against a market participant entering unlimited quantities of orders or placing orders beyond their ability to execute and clear those orders.

CME Clearing and Credit Controls

CME Group and our clearing members use performance bonds, appropriate margin methodologies and additional risk management tools to protect our markets.

An order cannot be entered without passing pre-existing credit checks set by clearing firms. These ensure that, even for short-term traders who may exit their positions by the end of the trading session, financial requirements of the clearing member and the exchange are met. In addition, CME Group collects margin twice daily to ensure financial security. Both CME Group and the clearing member’s objective is to ensure that the customer is fully able to meet their financial obligations no matter what the conditions in the market.

During Trading

In addition to our Market Regulation team monitoring the markets, a wide range of automated market protections are in place in the market to make it as efficient as possible. During the trading session, a number of other important tools are also at work in agricultural markets:

- Daily Price Limits are measured off the prior day’s settlement price and restrict a market from moving above or below a predetermined price limit level during a given trading session. Once a futures price has moved higher by its daily limit, there can be no trading at any higher price until the next day of trading. Conversely, once a futures price has declined by its daily limit, there can be no trading at any lower price until the next day of trading. Daily price limits expand the next trading session and are typically only used in markets where circuit breakers are not currently in place. In the case of grain and oilseed futures, daily limits will expand if two or more of the first five contract months settle at limit. For livestock, if one or both of the first two futures contract months settles at limit, their respective daily price limits will expand during the next trading session.

- Velocity Logic is functionality designed to detect market movement of a predefined number of ticks either up or down within a predefined time and introduces a momentary suspension in matching to ensure a given market doesn’t move “too far, too fast.” It uses a combination of price and time – the market can move only so far so fast before a Velocity Logic event is triggered. Once an event is triggered the market automatically begins a brief pause for a predetermined amount of time, ranging from 5-10 seconds. During this period, there is no trade matching. Customers can submit, modify, and cancel orders (no market orders). The pause allows for liquidity to replenish and the market to find equilibrium, particularly in times of market stress.

Messaging

In recent years, CME Group adopted the CME Globex Messaging Efficiency Program to encourage responsible messaging practices – making sure there are not too many messages taking up bandwidth compared to the volume of trade in the market.

Each product has a benchmark message-to-fill ratio against which the total messages, weighted with the below factors for each message type, are compared. For example, in the case of Corn, the message-to-fill ratio it is 50:1, while in the case of Live Cattle it is 20:1. In the case of Live Cattle, this means that for every 20 messages, CME Group expects one fill. If an executing firm’s daily message-to-fill ratio exceeds the benchmark, CME Group levies a surcharge of $1,000 per product group, per day.

It is important that messaging programs provide guidelines without excessively constraining participants and therefore impacting liquidity – just as if pit traders had been told they could only bid or offer a set number of times before they had to buy or sell. For example, hedgers put in an order and expect it to be filled. They may need to move or modify their order if the market conditions change, but not that frequently. Their message-to-fill ratio is likely quite low. On the other hand, the messaging also has to work for the perspective of a market maker who typically will layer the book – that is have bids and offers at multiple levels above and below the market. As the market moves, market makers are constantly moving orders to frame the current market price and to manage the positions they are carrying. To do this effectively, their message-to-fill ratio can be much higher than that of the average hedger, and it is especially high in volatile markets.

Market Regulation

CME Group has a vested interest in preserving the integrity of its markets and accordingly employs substantial technological and human resources in its Market Regulation department to protect the market from disruptive activity.

Over the years, Market Regulation has developed a highly granular and precise audit trail consisting of all electronic order messages on CME Globex. Every order, modification, and cancellation message, a record of every transaction, as well as every market data message is captured and maintained in this audit trail, most of which is timestamped to the nearest nanosecond. We further enrich the audit trail with outside reference data and position information.

Market Regulation analyzes the audit trail data using highly sophisticated tools and programmatic reviews designed to identify specific types of violative and abusive market activity. Market Regulation also performs ad hoc research, social media monitoring, and reviews of complaints to identify problematic activity not identified by the program reviews. When anomalous activity or aberrations in market conditions are identified, comprehensive reviews are performed and documented. If a review concludes that disciplinary action is warranted, Market Regulation pursues those actions through an established enforcement program.

Continual Evolution

Over the past decade, CME Group markets have evolved significantly as customers have shifted their business from the pits to the screen. This has created new market dynamics and challenges for both traders and exchanges. CME Group continues to evolve its platform, rules, tools, and monitoring capabilities with the goal of ensuring its markets retain the highest integrity and are the most effective for meeting customers’ risk management needs today and into the future.

Should you have additional questions, please contact us at agriculture@cmegroup.com.

Read original article: https://cattlemensharrison.com/overview-what-makes-ags-markets-work/

By: CME Group