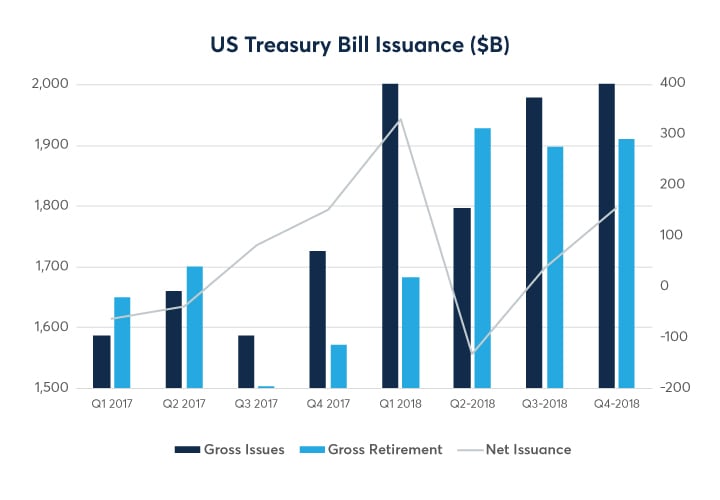

Exhibit 1: U.S. Treasury Bill Issuance (from SIFMA)

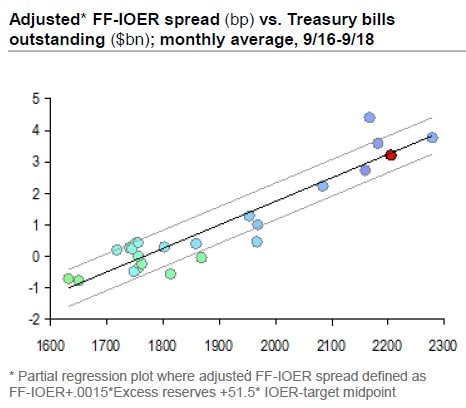

A recent JP Morgan analysis documents the positive correlative relationship between the EFFR-IOER spread and supply of outstanding Treasury bills (Exhibit 2). Among the implications is that the LIBOR-OIS spread can turn volatile, not only in response to bank credit swings but also during times when banks hold more than adequate reserves. For market participants with exposure to movements between these rates, the inter-commodity spread can serve the same purpose as a basis swap.

Exhibit 2: EFFR-IOER spread versus Treasury Bill supply2

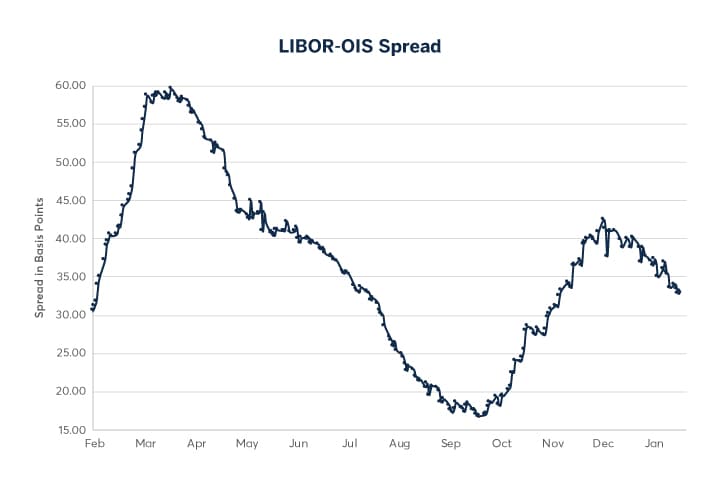

Exhibit 3: LIBOR-OIS spread, early 2018 to early 2019 3

Between late 2017 and spring 2018, the LIBOR-OIS spread increased from around 10 basis points to over 50. When Treasury bill issuance subsequently dropped off, the spread retraced (a move that may have been amplified by the repatriation of overseas corporate investments following passage in December 2017 of the US Tax Cut and Jobs Act) (Exhibit 3).

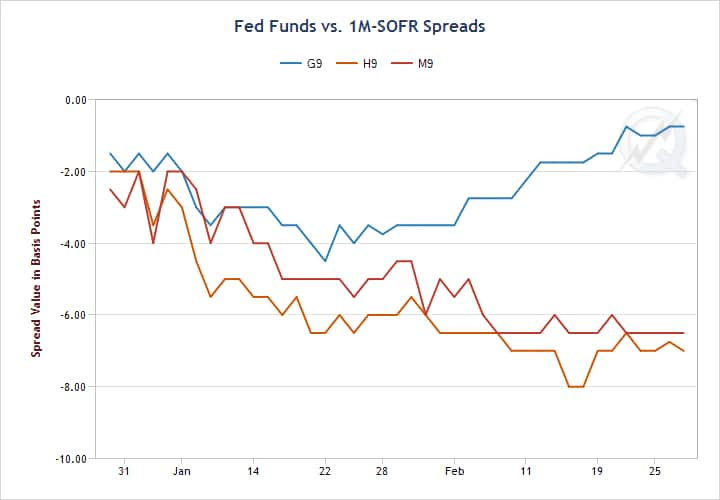

Inter-commodity spreads between GE futures and ZQ futures concurrently traded in the 30-40 basis point range, relaxing a bit into the autumn, with a few spikes near the end of the year. Their overall behaviour broadly followed LIBOR-OIS trends, albeit with greater daily movement (Exhibit 4).

A further consideration is that the EFFR has trended toward the top of the FOMC’s prescribed intermeeting target range. The FOMC generally prefer for realized EFFR values to reside comfortably within the target range, and they have indicated their willingness to use reductions in the IOER (or increases that lag the EFFR target range) as a means to effect this outcome.4 However, it’s not clear this will move the EFFR, rather than simply compressing the spread between IOER and EFFR (as well as the spread between IOER and SOFR).

In the below exhibit, the spread is each Eurodollar quarterly rate (March, September, June, and December 2019 expiries) less each average of two subsequent Fed Funds serials (April/May, July/August, and October/November 2019; January/February 2020). Alternately, it is the ZQ average price less ED quarterly price. Details on initiating these multi-leg spreads on CME Globex can be found at the presentation linked below.5

Exhibit 4: Eurodollar vs. Fed Funds futures spread 6

Inter-Commodity Spreads Featuring SOFR

By virtue of its comprehensive link to activity in Treasury general collateral repo markets, SOFR can and frequently does exhibit more day-to-day volatility than survey-based STIR benchmarks. An IOER setting that lies near the prevailing level of market repo rates is likely to drive swings in the decisions by which banks choose where to park idle reserve balances, thereby amplifying daily swings in SOFR. For this reason, among others, inter-commodity spreads among SR1, SR3, GE, and ZQ futures may emerge as increasingly important tools to manage volatility.

For example, the GE-SR3 spread witnessed a runup in 2018 similar to the GE-ZQ spread, with a slightly wider range (Exhibit 5). SR3’s use of compounding of daily SOFR values serves to smooth out day-to-day movements in SOFR, narrowing the range of likely final settlements as the contract period of interest rate risk progresses toward its conclusion. The recent downtrend may indicate a shift in the market consensus expectation toward no further Fed hikes in 2019. If so, it would be consistent with analytical results available through the CME FedWatch Tool7.

In the below exhibit, the spread is SR3 price less GE price (or GE-SR3 rate):

Exhibit 5: Eurodollar vs. Three-Month SOFR futures spread 8

In contrast, the spread between ZQ and SR1 prices is much tighter and exhibits smaller overall movements. As before, even though SOFR is much more volatile from day to day than the EFFR, the averaging serves to flatten the volatility in monthly final settlement prices:

In the below exhibit, the spread is SR1 price less ZQ price (or ZQ-SR1 rate):

Exhibit 6: Fed Funds vs. One-Month SOFR futures spread 9

Since turn of year, a divergence has emerged between the front month (February) and deferred quarterlies (March, June). One potential explanation is that market participants are collectively pricing in a reduction in repo rates relative to EFFR in coming months; an alternative is that EFFR is expected to resume its rise toward IOER and away from SOFR:

Exhibit 7: Fed Funds vs. One-Month SOFR futures spread (recent)

A glance at underlying STIR benchmark trends confirms the earlier observation about the smoothing effect of contract final settlement price mechanisms: short term swings in SOFR due to repo market volatility are dampened in their impact upon futures final settlement prices. Futures market movements therefore incorporate underlying daily fixings but moderate any single daily rate change.

Exhibit 8: EFFR vs. SOFR rate comparison 10

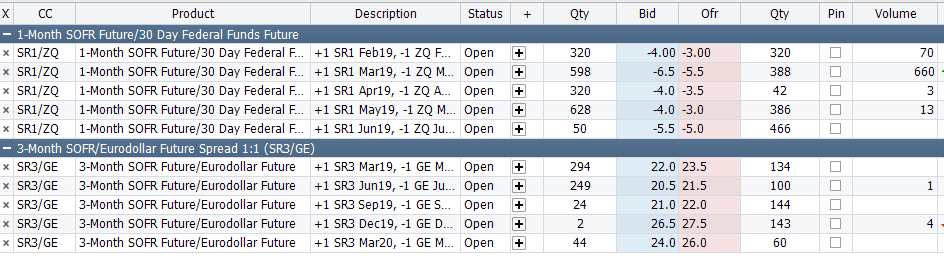

Both the more volatile SR3-ED and the tighter SR1-ZQ spreads have seen increased activity in recent months, with average daily volume trending upward. Bid-offer spreads of one basis point are typical, with market depth frequently sufficient to accommodate trade sizes running to several hundred contracts.

The following snapshot of the CME Globex ICS market from early February is representative:

SR3-ZQ and SR1-ED spreads also are available. For these, the leg ratio is 10:6, to adjust for the $25 and $41.67 tick values. The ICS list includes:

– One-Month SOFR/30-Day Federal Funds SR1/ZQ

– Three-Month SOFR/Three-Month Eurodollar SR3/GE

– One-Month SOFR/Three-Month SOFR SR1/SR3 (10:6 spread)

– 30-Day Federal Funds/Three-Month SOFR ZQ/SR3 (10:6 spread)

Over the medium- term – months or quarters – SOFR’s dynamics are positively correlated with those of other familiar STIR benchmarks, such as EFFR or ICE LIBOR®. But over shorter intervals – days or weeks – SOFR’s behavior is financially distinct. This enables SOFR futures to trade alongside the highly liquid Eurodollar and Fed Fund futures – as a natural complement — with enhanced spread trading capabilities via CME Globex inter-commodity spreads (ICS).

In addition, there are margin offsets of up to 85% between SOFR futures and adjacent Eurodollar or Fed Fund futures positions which provide substantial capital efficiencies. Along with increased T-bill issuance, movement in LIBOR-OIS and other money market spreads, SOFR ICS against ED or ZQ futures provide excellent risk management and relative value trading opportunities.

Vendor Codes 11

|

3-Month |

1-Month SOFR |

3-Month SOFR vs. Eurodollar |

1-Month SOFR vs. 30-Day Fed Funds |

1-Month SOFR vs. 3-Month SOFR |

30-Day Fed Funds vs. 3-Month SOFR |

|

|---|---|---|---|---|---|---|

|

Product Type |

Outright |

Outright |

1:1 Spread |

1:1 Spread |

10:6 Spread |

10:6 Spread |

|

CME Globex |

SR3 |

SR1 |

SR3 |

SR1 |

SR1 |

ZQ |

|

Bloomberg |

SFR Comdty |

SER Comdty |

SFRED |

SERFF Comdty |

SERSFR Comdty |

FFSFR Comdty |

|

Thomson Reuters Globex Chain RICs |

0#1SRA: |

0#1S1R: |

0#1SRA-ED: |

0#1S1R-FF: |

0#1S1R-S1R-SRA: |

0#1FF-FF-SRA: |

|

Thomson Reuters Composite Chain RICs |

0#SRA: |

0#S1R: |

0#SRA-ED: |

0#S1R-FF: |

0#S1R-S1R-SRA: |

0#FF-FF-SRA: |

|

TT |

SR3 |

SR1 |

SR3 |

SR1 |

SR1 |

ZQ |

|

CQG |

SR3 |

SR1 |

SGI0 |

SZI0 |

SRWI1 |

ZSWI1 |

|

FIS/SunGard |

SR3 |

SR1 |

SR3 |

SR1 |

SR1 |

ZQ |

|

Fidessa |

SR3 |

SR1 |

SR3 |

SR1 |

SR1 |

ZQ |

|

ION (Pats & FFastFill) |

SR3 |

SR1 |

Pending |

Pending |

Pending |

Pending |

|

Broadway Technology |

SR3 |

SR1 |

Pending |

Pending |

Pending |

Pending |

|

Stellar |

SR3 |

SR1 |

SR3-GE |

SR1-ZQ |

SR1-SR3 |

ZQ-SR3 |

|

DTN |

@SR3 |

@SR1 |

Pending |

Pending |

Pending |

Pending |

|

Itiviti |

SR3 |

SR1 |

Pending |

Pending |

Pending |

Pending |

- ICE LIBOR® is a registered trademark of Intercontinental Exchange Holdings, Inc. and is used under license.

- https://www.newyorkfed.org/medialibrary/media/newsevents/events/markets/2018/Terry-Belton-Treasury-Supply-Liquidity-and-Bank-Demand-for-Reserves.pdf

- Source: Bloomberg LLC

- See, eg, Simon Potter, Federal Reserve Bank of New York, “U.S. Monetary Policy Normalization is Proceeding Smoothly”, remarks at the China Finance 40 Forum/Euro 50 Group/CIGI Roundtable, Banque de France, Paris, France, October 26, 2018, available at: https://www.newyorkfed.org/newsevents/speeches/2018/pot181026

- Short-Term Interest Rate (STIR) Intercommodity Spreads on Globex (https://www.cmegroup.com/trading/interest-rates/stir-intercommodity-spreads.html)

- Data source: QuikStrike (https://www.cmegroup.com/tools-information/quikstrike/short-term-interest-rate-analytics.html).

- CME FedWatch Tool is available at: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

- Data source: QuikStrike (https://www.cmegroup.com/tools-information/quikstrike/short-term-interest-rate-analytics.html).

- Data source: QuikStrike (https://www.cmegroup.com/tools-information/quikstrike/short-term-interest-rate-analytics.html).

- Data source: QuikStrike (https://www.cmegroup.com/tools-information/quikstrike/short-term-interest-rate-analytics.html).

- See: https://www.cmegroup.com/trading/interest-rates/secured-overnight-financing-rate-futures.html

The Exchange has entered into an agreement with ICE Benchmark Administration Limited which permits the Exchange to use ICE LIBOR® as the basis for settling Three–Month Eurodollar futures contracts and to refer to ICE LIBOR® in connection with creating, marketing, trading, clearing, settling and promoting Three–Month Eurodollar futures contracts.

Three–Month Eurodollar futures contracts are not in any way sponsored, endorsed, sold or promoted by ICE Benchmark Administration Limited, and ICE Benchmark Administration Limited, has no obligation or liability in connection with the trading of any such contracts. ICE LIBOR® is compiled and calculated solely by ICE Benchmark Administration Limited. However, ICE Benchmark Administration Limited, shall not be liable (whether in negligence or otherwise) to any person for any error in ICE LIBOR®, and ICE Benchmark Administration Limited, shall not be under any obligation to advise any person of any error therein.

ICE BENCHMARK ADMINISTRATION LIMITED MAKES NO WARRANTY, EXPRESS OR IMPLIED, EITHER AS TO THE RESULTS TO BE OBTAINED FROM THE USE OF ICE LIBOR® AND/OR THE FIGURE AT WHICH ICE LIBOR STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DAY OR OTHERWISE. ICE BENCHMARK ADMINISTRATION LIMITED MAKES NO EXPRESS OR IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE FOR USE WITH RESPECT TO THREE–MONTH EURODOLLAR FUTURES CONTRACTS.

Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. All references to options refer to options on futures.

Any research views expressed those of the individual author and do not necessarily represent the views of the CME Group or its affiliates. The information within this presentation has been compiled by CME Group for general purposes only. CME Group assumes no responsibility for any errors or omissions. All examples are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience.

All matters pertaining to rules and specifications herein are made subject to and are superseded by official rulebook of the organizations. Current rules should be consulted in all cases concerning contract specifications

CME Group is a trademark of CME Group Inc. The Globe Logo, CME, Globex and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. CBOT and the Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are registered trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. All other trademarks are the property of their respective owners.

Copyright © 2019 CME Group. All rights reserved.

Read original article: https://cattlemensharrison.com/spreading-money-markets-with-sofr-fed-funds-and-eurodollars/

By: CME Group