The fact of an improving economic situation doesn’t mean that the ECB will be in any hurry to raise rates. Eurozone inflation remains extremely low, with core inflation nearly a point and a half below that of the U.S. (Figure 7).

This implies that the ECB can probably wait at least 12-18 months before raising rates. The major issue facing the ECB over the next year isn’t raising rates or ending quantitative easing (QE), the latter being a foregone conclusion; it’s choosing a successor to outgoing ECB president, Mario Draghi. The theoretical favorite is Germany’s Jens Weidmann. Weidmann, however, has opposed nearly every measure that Draghi has taken, sometimes vocally. With Europe’s recovery still four years behind that of the U.S. –owing in no small part to policy mistakes in 2010 and 2011 under the more hawkish Jean-Claude Trichet and Axel Weber—many Europeans are in no mood to have a policy hawk at the helm of the ECB.

As such, while Germany may feel that it is owed the chairmanship after having been held previously by the Dutch, French and the Italians, a variety of alternative candidates are being put forth to challenge Weidmann. Moreover, it’s not clear how hard Angela Merkel, who is beset by political problems at home, will fight on his behalf and what she might have to sacrifice in return for securing him the chairmanship. All in all, Draghi’s upcoming departure doesn’t necessarily signal a turn towards a more hawkish monetary policy in late 2019 and in 2020 –although such a development can’t be ruled out.

In the U.S., when Federal Open Market Committee (FOMC) chairs leave, they often try to normalize policy on their way out. Alan Greenspan’s FOMC hiked rates 16 times between June 2004 and May 2006 so that the incoming Ben Bernanke would have what the Fed thought (mistakenly) to be a neutral monetary policy. The FOMC hiked rates one last time in June 2006, the month that Bernanke took over. Seven years later, as Bernanke prepared to leave, he announced the tapering of QE in 2013 and ended it in 2014 as he prepared to turn over the reins to Janet Yellen. Likewise, she began to neutralize policy by bringing rates off zero and up to the level of core inflation as she handed the mantel to Jerome Powell earlier this year.

On a similar note, Draghi will almost certainly bring QE to an end before leaving the ECB in October 2019. Moreover, if the economy continues to grow strongly, he may also end the ECB’s experiment with negative rates as well. Depending upon who succeeds him, neither of these two actions should be perceived as suggesting that the ECB will soon begin hiking rates at anywhere near the pace at which the Federal Reserve is currently moving.

The Power of the Bond Market and the Syrizification of the Europe

On major risk to our dovish forecast for the ECB would be a dramatic fiscal deterioration in Europe owing to widespread tax cuts or spending increases. The biggest risk of such a fiscal loosening is in Italy, where the populist-left Five Star Movement entered into a coalition with the populist-right Northern League. Together they promised to cut taxes and raise spending. Moreover, both parties have sounded Euroskeptic and even anti-euro in the past. The market fired a shot across their bow when the Italian debt market began to crash in late May as they put their coalition together (Figure 8). Our sense is that now that they are in office, they won’t dramatically change policy.

We’ve seen this movie before. In September 2015, the Greeks elected Alexis Tsipras’s far-left party, Syriza, to run the government. During the electoral campaign, Syriza made noises about leaving the euro and the EU. Nearly three years on, Tsipras and his government are still in the EU, still in the euro and are busy adhering to their bailout terms. None of this has gone down well with the Greek voters. Syriza has lost about one third of its support, if the public opinion polls are to be believed, but Syriza’s erstwhile supporters have largely migrated to the pro-EU center-right party.

Italy’s Five Star Movement and the Northern League will likely find themselves towing a similar line. Criticizing the EU is easy to do when out of power. However, threatening to leave the euro when one is in power is a sure-fire way to generate a banking crisis. Our guess is that we will soon see the Syrizification of the both the Five Star Movement and the Northern League, with plenty of finger pointing to go around but with little in the way of policy changes.

Similarly, while Angela Merkel might be forced out of office before year’s end, Germany won’t likely alter its fiscal course substantially. Among her possible replacements, there are differing attitudes towards how to handle the refugee issue but not much policy debate involving sweeping tax cuts or spending increases.

It’s a similar story in Spain where the center-left Pedro Sanchez replaced the center-right Mariano Rajoy as Prime Minister last month without so much as holding an election. The new government, which relies on Basque and Catalan parties to keep it in power, is in no position to radically alter Spain’s fiscal course.

Even in France, the one country with a decisive President and parliamentary majority, Macron’s popularity is sinking, and his party is beginning to fray. France has been focusing mainly on structural reforms to the labor market and to retirement system and is making technical changes to its tax collection methods but without dramatically changing the overall level of taxation and spending.

Lastly, there is still nervousness about the state of German and Italian banks. While there is some cause to be concerned about low profit margins and some degree of undercapitalization, the risk of a major bank failure or other catastrophic outcome is close to zero. It’s hard for banks to fail when they can borrow for free. That said, if the ECB were to hike too quickly, banking troubles could emerge, but this seems a distant prospect at best. Moreover, some policy normalization, such as an end to QE and to negative interest rates, might actually boost bank profits without hurting Europe’s borrowers.

At the moment, for all of the talk of political chaos in Europe, remarkably little in changing. Investors seem to think that the political disruption is a bad thing for the euro and a good thing for fixed income (in the sense that its driving bond prices higher in Europe’s core –Germany and France—and yields lower). However, investors may eventually come to see the positive side to political gridlock and paralysis: the deleveraging process can continue to the benefit of Europe’s future growth.

Market Outlook

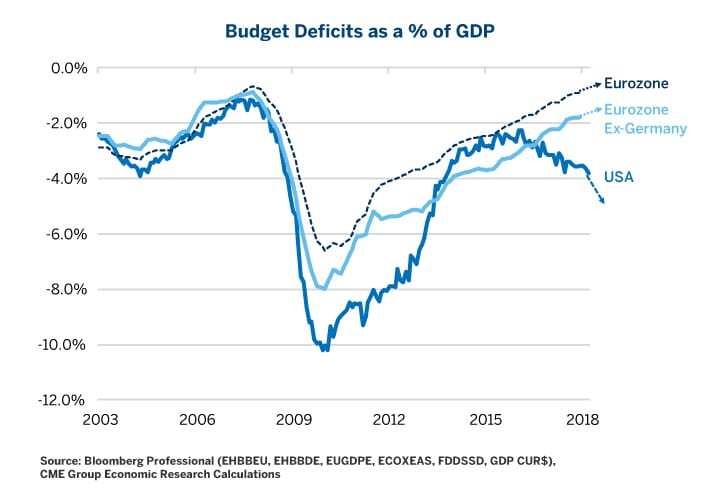

The EURUSD exchange rate remains in a tug-of-war. Fed monetary policy tightening combined with ECB inaction is pulling USD higher and EUR lower. Political concerns in Europe from Brexit to the stability of the governing coalitions of Germany, Italy and Spain are also pulling the euro lower. That said, fiscal policy is serving as a counterweight. Europe’s fiscal position continues to improve while U.S. budget deficits explode. Overall, EURUSD might continue trading in its post 2014 range of 1.03-1.25 until something happens on one side of the Atlantic for the other to shift the needle decisively.

When it comes to bonds, continued growth in the Eurozone, the likelihood that Italian and German politics won’t, in the end, spiral out of control, and an end to QE, could put a bearish tilt on the EU’s bond markets. Any sell-off in European bonds could, in turn, prove bearish for U.S. Treasuries as we head into the end of the decade. After all, extremely low European yields are probably one reason why long-term U.S. bonds have been unable to achieve higher yields even amid Fed tightening, a strong labor market and a modest rise in inflationary pressures.

Bottom Line

- Key European countries are governed by fragile coalition governments

- Populist governments will likely moderate once in power

- European economic indicators continue to improve

- Many European nations are achieving a dramatic post-crisis deleveraging

- Public sector finances continue to improve

- European banks may have challenges, but bank failures are unlikely with zero rates

- EURUSD remains caught in a fiscal versus monetary policy tug-of-war

- If investors focus on Europe’s growth, Eurozone fixed income could sell off to the detriment of U.S. Treasuries

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

-

Recommended For You

Read original article: https://cattlemensharrison.com/euro-u-s-dollar-the-sway-of-politics-and-the-economics/

By: CME Group