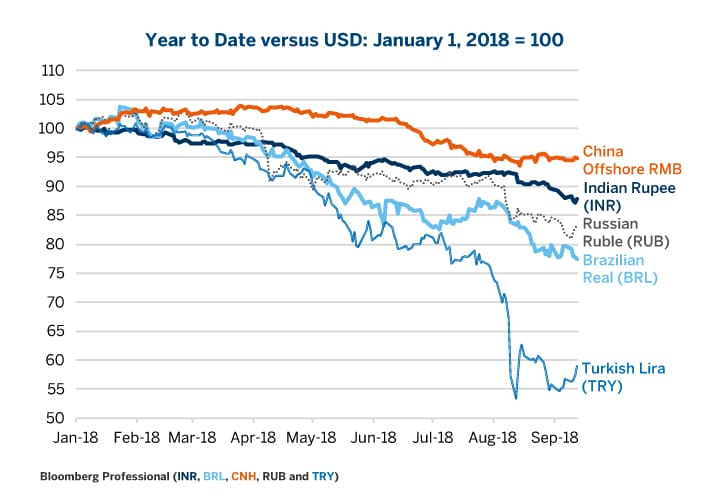

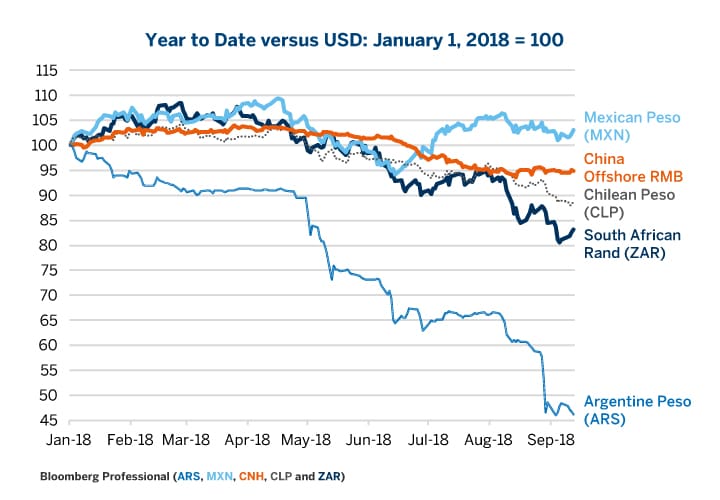

While all the emerging market currencies, except the Mexican peso, are down versus the U.S. dollar (USD) year to date, and rising U.S. rates are getting part of the blame, each currency faces its own unique economic situation and set of risk factors. If 2018 does turn out to be the beginning of a generalized 1997-98 style emerging market currency crisis, the reasons for the weakness and severity of the eventual outcome will likely differ substantially from one currency market to the next. There are three factors that we think will prove most important to determining the relative performance and fate of the various currencies:

- Debt and debt-service ratios

- Dependence on external financing

- Style of Crisis: Potential debt deflation depression or hyperinflation

Below we evaluate how eight currencies – Brazilian real (BRL), Chilean peso (CLP), Chinese renminbi (RMB), Indian rupee (INR), Mexican peso (MXN), Russian ruble (RUB), South African rand (ZAR) and the Turkish lira (TRY) – might stack up on these various measures.

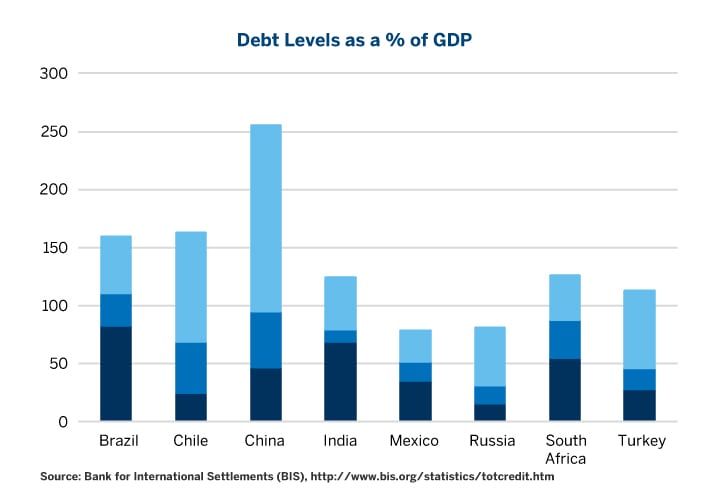

Debt and Debt-Service Ratios

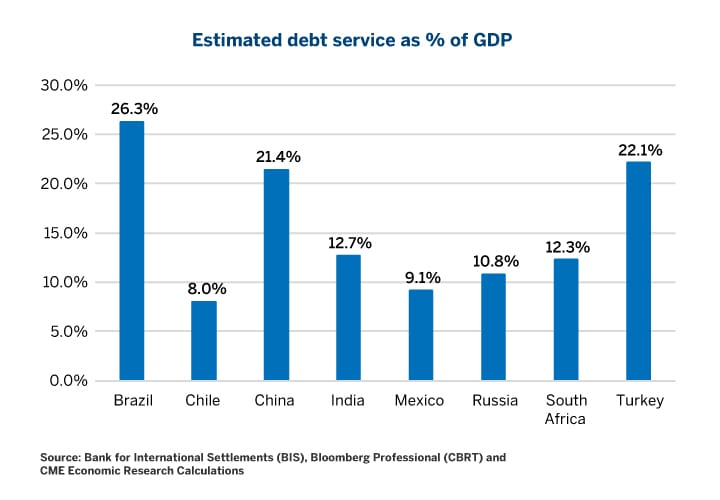

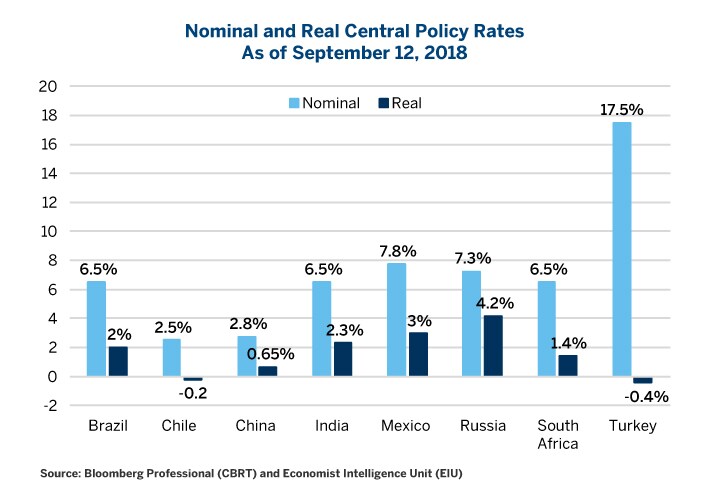

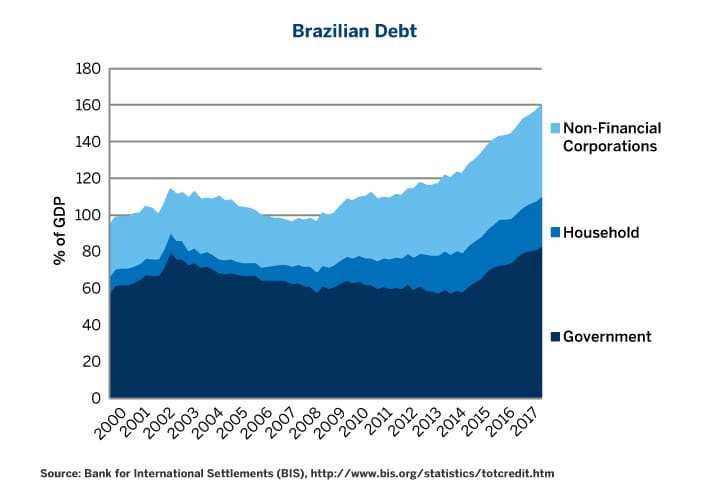

Generally speaking, the higher the levels of leverage, the greater the fragility of the financial system when faced with a shock. While overall debt levels are interesting to consider, the type of debt and the level of interest rates also matters. The shorter the average maturity of the debt and the higher the interest rate, the lower the threshold at which a debt crisis could be triggered.

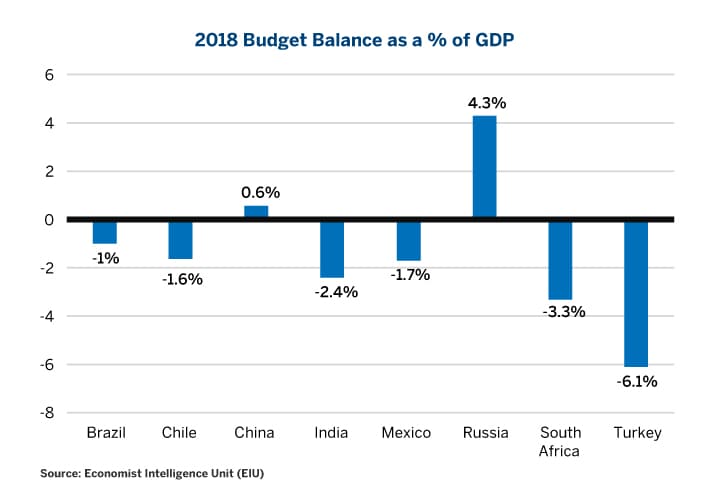

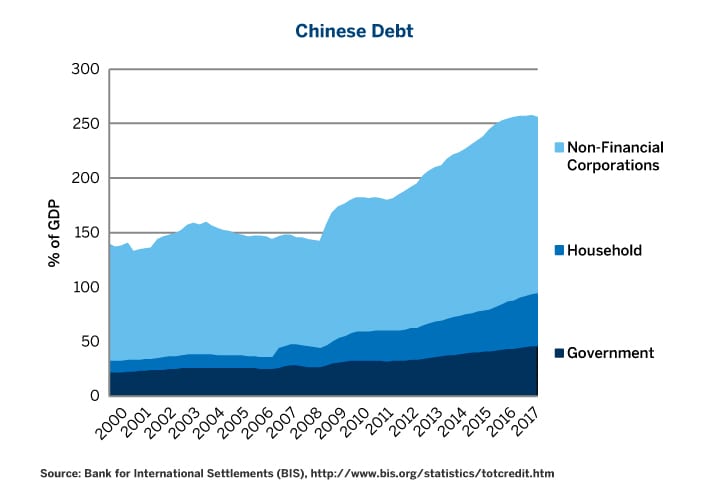

China leads the emerging market currencies in terms of debt, with total debt of more than 250% of GDP. By contrast, Mexico and Russia have very little debt (Figure 3). However, these general figures disguise a number of deeper issues. First, the cost of financing the debt varies significantly from one country to the next due to vastly differing levels of interest rates. From this perspective, China, where much of the debt is probably financed at interest rates between 2.75% and 7%, has a lower interest rate cost of debt service than, say, Brazil or Turkey where debt ratios are lower but the cost of interest is much greater.

Interest payments are only one feature of debt service, however. The other issue is amortization of the debt – in other words, how long is the average maturity of the debt and how soon does it come due? In developed countries, average maturities are usually around 6-8 years. In many emerging market countries with a history of high rates of inflation, such as Mexico and Brazil, there are few loans with a maturity of more than five years. So, the average maturity is probably more like 2-2.5 years. In China, India and Russia, loans rarely extend for more than 10 years and the average maturity is probably closer to 4-5 years. South Africa has the most developed capital markets for long-term loans and is unique among the emerging markets to have average maturities akin to those in developed economies.

As such, the “leaders” in debt service ratios are Brazil, China and Turkey. The most insulated from debt shocks appear to be Chile, Mexico and, to a lesser extent Russia, with India and South Africa in the middle of the pack (Figure 4). What’s curious is that Brazil and Turkey have experienced recent financial crises whereas China has not. The reason why China hasn’t yet experienced a debt crisis has a great deal to do with the manner in which China finances it debt.

Dependence upon External Financing

China’s ability to sustain high debt levels and high debt-service ratios is a function of its deep pool of domestic savings and limited dependence on external financing. This contrasts sharply with a nation like Turkey, which now finds itself in a position analogous to Thailand in 1997 when significant private-sector borrowings in foreign currencies led to trouble when the baht collapsed.

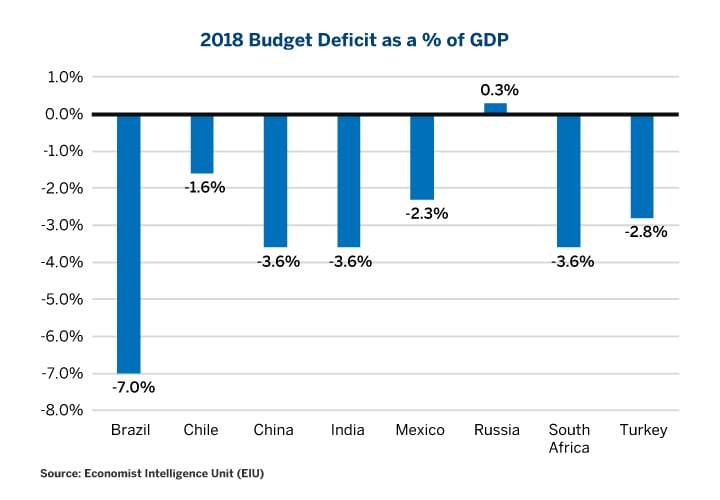

Finding exact statistics on what percentage of private sector debt is owed in foreign currencies can be a challenge. That said, there are two proxies to watch. The better of these is the current account balance (Figures 5 and 6), and arguably less reliable is the government budget deficit.

Countries that run large trade deficits have to finance themselves with capital borrowed from abroad. Strong economies that embrace property rights and the rule of law will tend to attract capital, and a current account deficit is the arithmetical offset. Strong economies also will tend to consume more than weaker economies, so a current account deficit is a natural state as imports exceed exports. For the United States there is a further consideration: the trade and current account deficit also reflects the status of the U.S. dollar as the world’s reserve currency. As the world’s reserve currency, the U.S. can borrow more cheaply on average and over time because governments and many businesses around the world must have dollar holdings to engage in international commerce and transactions. This is not the case with currencies like the Turkish lira. For emerging markets, running large trade and budget deficits is usually unsustainable, and as the saying goes, “that which is unsustainable will not be sustained.” Budget deficits are a somewhat weaker indicator because countries like China that have deep pools of domestic savings can finance them if necessary.

With respect to budget deficits, Brazil is in a remarkable situation with a sizable 7% deficit-to-GDP ratio. Not even the countries of Western Europe or the U.S. can sustain such large deficits for extended periods without making painful choices such as raising taxes and slowing the growth of spending. Only Japan, with zero rates and a deep pool of domestic savings, has been able to run analogously sized deficits over extended periods of time. With 7% interest rates and a dependence on external financing, Brazil’s situation looks nothing at all like Japan’s.

Nature of Crisis: Debt Deflation Depression or Hyperinflation?

Currency crises represent a loss of confidence in the ability of a country to maintain financial imbalances. Usually they are triggered by a combination of excessive debt (private or public), unsustainable debt-service ratios, and sometimes by large external imbalances owing to money borrowed in foreign currencies or large current account deficits.

Resolving such currency crises usually involves painful choices for both lenders and debtors. Often, lenders have to accept ‘haircuts’ on loans or longer maturities on debts. The country itself usually has to reduce external deficits and budget deficits by raising interest rates, cutting government spending and raising taxes. Once budget and current account deficits are reduced and debt is restructured, recovery can begin, but the process is painful.

If creditors, debtors and government officials don’t make difficult choices, the crisis will likely worsen and they tend to deteriorate in one or two ways: either a debt deflation depression or a hyperinflation. Debt deflation depression, such as the one in the United States in the 1930s, Japan in the 1990s or Greece during the past decade, involves a vicious spiral of bank failures, economic downturn, falling wages and weak consumption which beget more bank failures. Policy responses differ from country to country and situation to situation, but currency devaluation isn’t a guarantee.

Emerging market crises rarely go in the direction of the debt deflation depression, and more often move towards a hyperinflationary depression. Rather than resolving unsustainable external imbalances through higher interest rates, higher taxes and reduced government spending, often leaders try to force the central bank to keep monetary policy easy to maintain the external imbalances. Inevitably, this leads to further acceleration in inflation. Attempts to contain inflation through wage and price controls, in turn, will lead to shortages and hyperinflation in the black market. Germany during the 1930s as well as Zimbabwe and Venezuela during the past decade are classic examples of hyperinflation. The U.S. even briefly tried price controls in the mid-1970s, and that did not work out well either.

In addition to looking at tax and spending changes, one key factor to look at is the level of real interest rates. If the central bank holds real rates below the level of inflation, then that is an indication that the central bank has not tightened sufficiently, as was the case in Turkey until September 13, 2018 when the central bank raised rates (Figure 7). Negative real rates are a logical response to debt deflation depressions, such as on the one that threatened the United States in the aftermath of the 2008 meltdown. However, negative interest rates are more practical in developed markets facing disinflationary pressure than they are in emerging markets.

Risk Factors by Currency

BRL – Brazilian Real: Fiscal and Political Risks

Everything is on hold in Brazil until the outcome of the Presidential election in late October 2018. Whoever wins will face the unenviable task of tackling Brazil’s massive 7%-of-GDP budget deficit and excessive levels of public and private sector debt (Figure 8). Dealing with these problems will eventually mean increasing government revenue collection and cutting spending. In Brazil spending cuts mean reforms to generous pensions for state employees and other transfer payments and could prove deeply unpopular. If the new government takes decisive action towards this end, it could ultimately strengthen the real. Moreover, lower government spending and increased taxes would slow economic activity and inflation, perhaps allowing the central bank to lower rates which, in turn, would lower debt-service costs and mitigate the negative impact of tighter fiscal policy.

On the other hand, should the incoming government prove unable or unwilling to face these challenges, Brazil’s fiscal situation could continue to deteriorate, leading to a loss of confidence in the currency and the bond market. Moreover, a failure to deal with Brazil’s fiscal deficits could prevent the central bank from cutting rates and easing debt-service burdens.

There are some bright spots in Brazil. So far, the central bank has done a decent job of containing inflation and is perceived as being independent of political authorities. So long as this remains the case, it should prevent Brazil from going down the path to hyperinflation. If the new administration interferes with the central bank’s independence, however, Brazil could potentially head towards hyperinflation – an affliction that the country experienced frequently between 1980 and 1994 – an unlikely but nevertheless not impossible outcome.

CLP – Chilean Peso: Some Private Sector Risks and Exposure to Commodity Prices/Chinese Demand

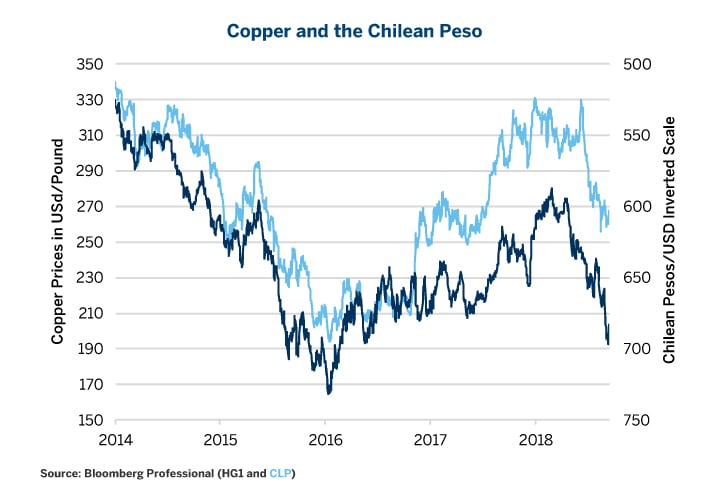

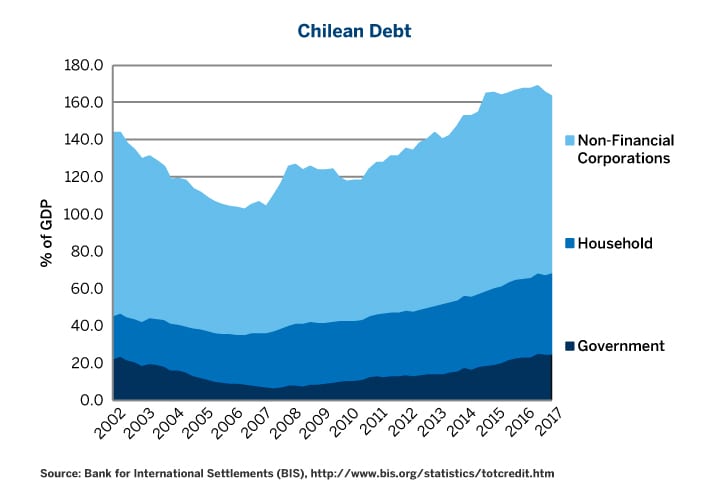

Although the Chilean peso has weakened against the dollar this year, it is moving lower largely in line with other currencies and in response to lower prices for its primary export: copper (Figure 9). The good news for Chile is that inflation is contained, investors perceive the central bank as being credible and the country has low levels of government debt at around 20% of GDP. The potentially bad news is that the country’s private sector debts are quite high, which creates some risk of defaults in the private sector should economic activity slow (Figure 10). To a great extend the future of Chile’s exports depend on growth in China, which consumes 40-50% of the world’s metal mining output.

Chinese Renminbi: Risk of Debt Deflation Depression

China’s main challenge is dealing with its massive debt. What makes China different than other emerging markets is that it finances that debt from a deep pool of domestic savings rather than from borrowing internationally. Even so, Japan, Western Europe and the United States all began their domestically denominated debt crises when combined public and private sector debt grew to exceed 225% of GDP, after which growth slowed sharply. China’s debt levels total 257% of GDP, over 120% higher than they were a decade ago (Figure 11).

For the moment, China has not experienced a Japanese, European or American-style “Minsky moment,” where there is a sudden loss of confidence in the soundness of the financial system. There are two reasons for this. First, Chinese interest rates are still low, with the central bank’s policy rate at 2.75%. When Japan’s crisis began in 1990, interest rates were close to 8%. In Europe and in the U.S., crises began in 2007 and 2008 with policy rates closer to 4.5-5.25%. China’s debt may be sustainable so long as interest rates remain low. The flip side, however, is that low interest rates might encourage further debt accumulation.

While the People’s Bank of China has a relatively supportive monetary policy, it may be challenged by the Fed’s tightening, which is increasing the attractiveness of the US dollar at the expense of the Chinese renminbi. Watch China’s official reserves to see how much stress this puts on its currency. If reserves slide below $3 trillion, it could be a sign on an impending devaluation.

Secondly, while China’s growth may be decelerating a little, overall growth continues to be robust. So long as growth continues at a good pace, the cash flows necessary to service accumulated debt will be available. The risk is that once a slowdown begins in earnest, then debt defaults begin to rise. This has the potential to lead to a sudden loss of confidence (a “Minsky moment”) in which growth falls in a self-reinforcing vicious spiral with lower and lower confidence levels.

To that end, the trade war represents a risk. The higher the tariffs and the broader the range of products affected the greater the potential damage to Chinse growth. China has the means to offset the potential damage from a trade war but none of them are especially attractive. In September China cut taxes, which should boost growth slightly but at the expense of incurring higher public-sector debt levels in the future. Stimulus spending would have a similar impact: boosting short-term growth at the expense of creating a larger long-term fiscal burden.

China claims that it has a deleveraging plan. Its deleveraging plan, however, is more accurately characterized as a debt management plan: move debt out of the shadow banking system and into the official banking system, and to reduce the debt of non-financial corporations and increase public debt.

Currency is also a big risk for China. While the Renminbi has been falling versus the US dollar, it has been moving higher versus nearly all other currencies, which could harm China’s competitiveness and slow its economy.

China has near-zero risk of a hyperinflation but some risk of experiencing a debt deflation depression. If China’s growth rate slows and its experiences a “Minsky moment,” there will be a significant risk that China will need to devalue its currency. For the moment, China’s FOREX reserves are stable and a currency devaluation appears to be a distant prospect, but there is a significant risk that such an event could occur during the next five years. Allowing the renminbi to float more freely could soften eventual impacts. If China’s growth slows and if the renminbi is devalued , watch out for potentially negative impact on other emerging market currencies and the prices of industrial metals, platinum group metals (PGMs), energy and agricultural goods (but perhaps not gold).

INR – Indian Rupee: Low Risk of Crisis

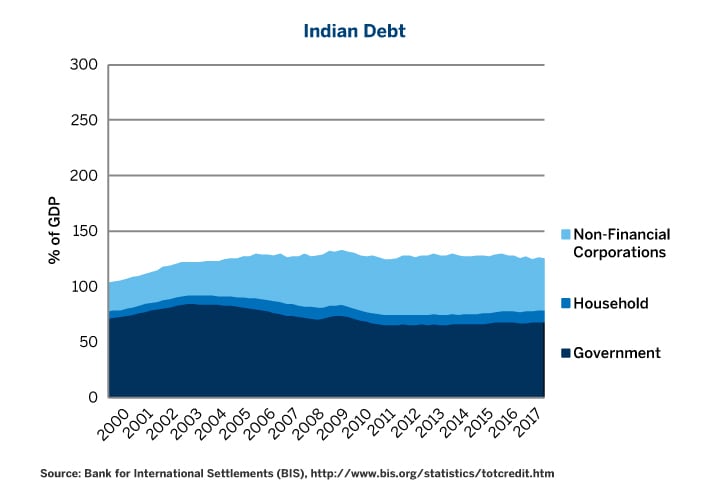

India is an unusual case of an emerging market. Unlike Brazil, Chile or Russia, it is a commodity importer and not a commodity exporter. This makes it a bit more like China. Unlike China, however, India has extremely low levels of private-sector debt, although its public-sector debt is arguably too high (Figure 12). As such, we see the rupee as being an exceptionally stable emerging market currency, and not as prone as the others to extreme moves. That said, India is not immune from international developments and the rupee will likely follow other emerging market currencies.

India’s longer-term issue is improving infrastructure and productivity. Much depends on the success of the Modi Administration’s economic policy, including the possibility of land reform.

MXN – Mexican Peso: The One Emerging Market Currency to Rally in 2018

MXN suffered after the 2016 U.S. elections and was generally weak through 2017, at a time when most other emerging market currencies rebounded. Investors were afraid of the potential end of NAFTA. Now that Mexico and the U.S. have made progress towards concluding a replacement to the original agreement, the peso appears to be in the clear and is rebounding at a time when most other emerging market currencies are selling off.

MXN has been helped by a credible central bank that is both independent and holding the line on inflation. Moreover, Mexico also has low debt levels and reasonable debt service levels. As such, while MXN may begin to correlate positively with the rise and fall of other emerging market currencies as it often has in the past, Mexico itself appears to be at a low risk of a near-term crisis. For the moment markets appear confident that incoming President Andres Manuel Lopez Obrador (AMLO, for short) won’t rock the boat too much. That said, we will have to wait and see the policies he will pursue once he assumes office on December 1, 2018.

RUB – Russian Ruble: Sanctions Weighing on an Otherwise Healthy Picture

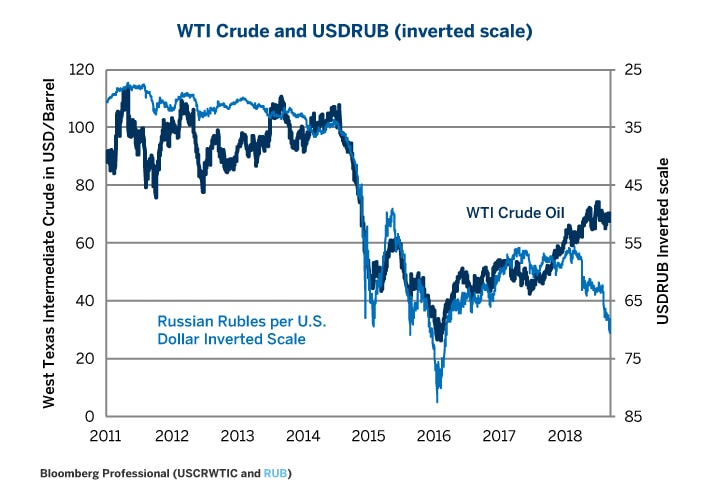

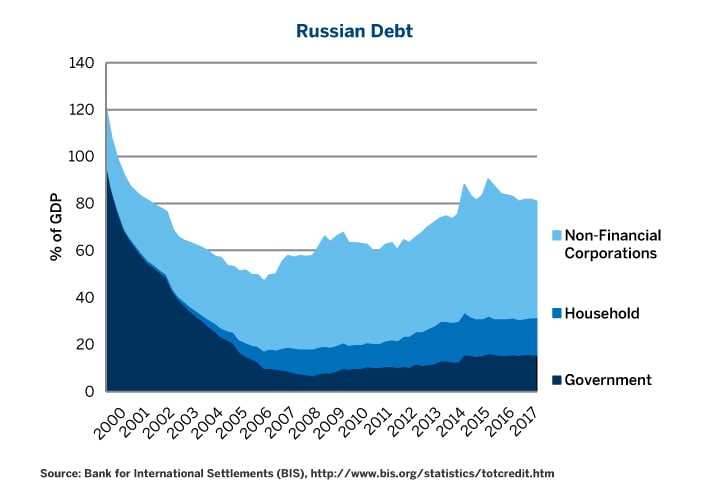

Normally, the Russian ruble closely tracks oil prices (Figure 13) but has recently underperformed. The impact of Western sanctions and the selloff in other emerging market currencies have a great deal to do with its recent weakness. Otherwise, the Russian picture is pretty healthy: extremely low levels of debt (Figure 14), reasonable debt service ratios, a central bank that is taking a tough line on inflation and both trade and budget surpluses. If sanctions were removed, the Russian ruble could soar. President Putin’s pension reforms might be unpopular but they are taking the country in the direction of long-term fiscal soundness and could also be bullish for the currency. That said, a selloff in other emerging market currencies or in oil prices could still drag the ruble lower.

ZAR – South African Rand: Hopeful with a New Administration

The rand strengthened by over 25% versus USD between November 2017 and February 2018 as it became clear that anti-corruption candidate Cyril Ramaphosa would become the country’s next President. Since he assumed office on February 15, the rand has tracked the prices of South Africa’s commodity exports and other emerging market currencies.

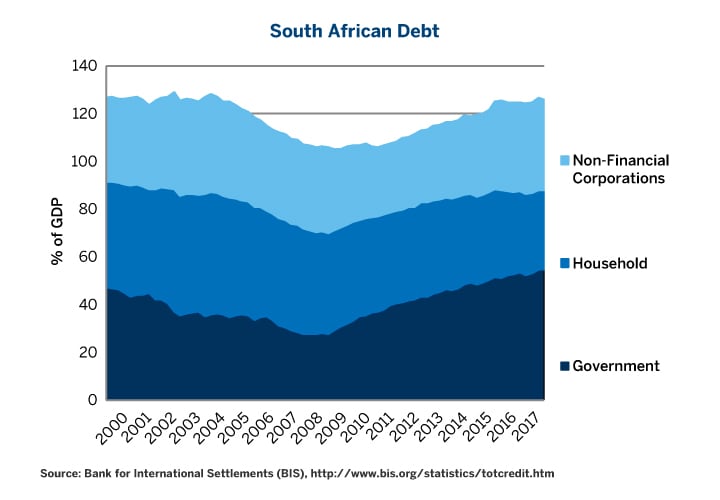

Although South Africa’s public debt is arguably higher than it should be, private sector debts are modest (Figure 15), and the risk of a near-term financial crisis appears moderately low. To the extent that Ramaphosa’s Administration is able to reduce corruption, the rand should benefit. South Africa could benefit from further fiscal consolidation and a somewhat tighter monetary policy. Achieving these could likely boost the rand, although they could slow growth and prove politically unpopular.

TRY – Turkey: A Hyperinflation Avoided?

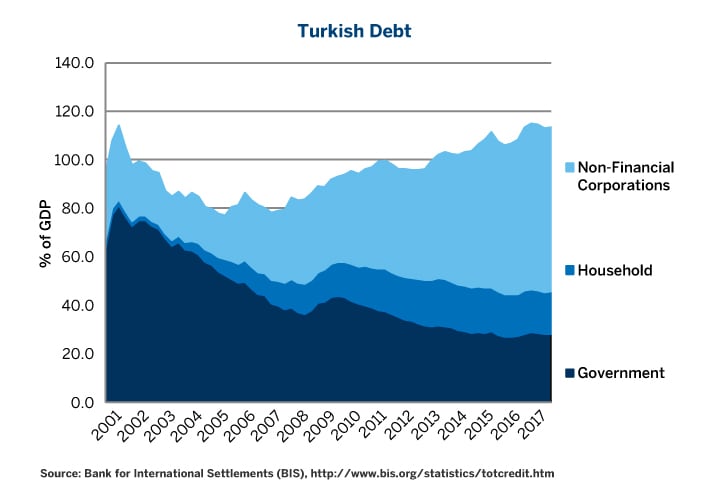

Turkey accumulated significant external imbalances with a trade deficit financed by borrowing in foreign currencies and a large budget deficit. The Erdogan Administration encouraged an extremely fast pace of growth that overheated the economy and built up private sector debt (Figure 16) that led to rampant inflation.

As Turkey’s currency collapsed over the summer, the government’s response appeared to be moving Turkey towards hyperinflation. It refused to restructure debt, cut spending, raise taxes or permit the central bank to raise rates. The attack on the central bank’s independence was particularly worrisome and Erdogan said that higher interest rates could increase rather than lower inflation – something that basically no economist or investor anywhere in the world believes to be correct.

On September 13, the Turkish government abruptly changed course. It allowed the central bank to raise rates to 24% from 17.75%, putting the real rate above the official trailing measure of inflation. Moreover, Turkey restructured debts denominated in foreign currencies into the Turkish lira. This step has the short-term advantage of making the debts somewhat easier to service but the potential long-term disadvantage of discouraging foreigners from lending to the Turkish private and public sectors.

Turkey isn’t out of the woods yet. It’s inflation rate may rise well beyond 17.75% in the next few months and the impact of the recent currency collapse is factored into prices. This could force the central bank to tighten further, setting up a potential conflict with the Erdogan Administration if it tries to prevent the central bank from tightening policy further. On the fiscal side, Turkey probably needs some fiscal consolidation which could also prove unpopular. Resolving Turkey’s problems will take time and will probably require slowing economic growth enough to reduce the current account deficit and bring it towards surplus for several years. That said, having just secured another mandate with a large majority in the legislature, Erdogan is perfectly positioned to ride out the storm with a few years of pain in the hopes of finding the economy in a stronger position at the time of the next elections scheduled for June 18, 2023. Now we’ll have to see what Erdogan and company choose to do.

Bottom line:

- Emerging market currencies have been falling, with Argentina and Turkey leading the way.

- Tighter Fed policy has been increasing stress in emerging markets (EM).

- EM economies differ sharply from each other with respect to inflation, central bank policy, debt ratios and external balances.

- Chile, Russia, Mexico and India appear to be the best positioned to contain currency weakness.

- Brazil and Turkey face significant risks going forward. Inflation is a major threat going forward if issues are left unresolved.

- China must grapple with the trade war, excessive debt levels and disinflationary pressures.

-

Recommended For You

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Read original article: https://cattlemensharrison.com/bright-spots-in-emerging-market-currencies/

By: CME Group